Insights

Understand the current market trends with the latest news, strategies, and analysis.

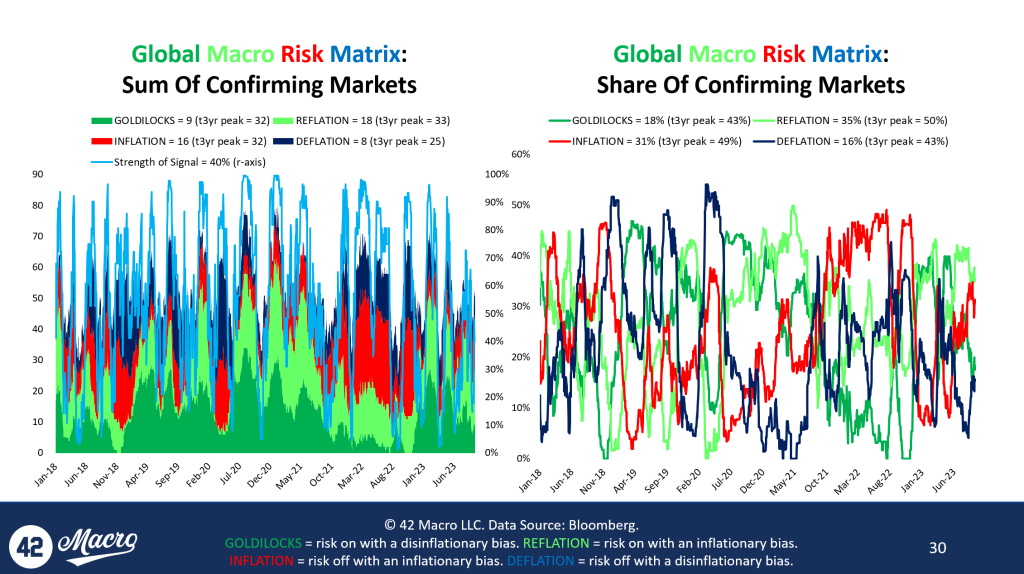

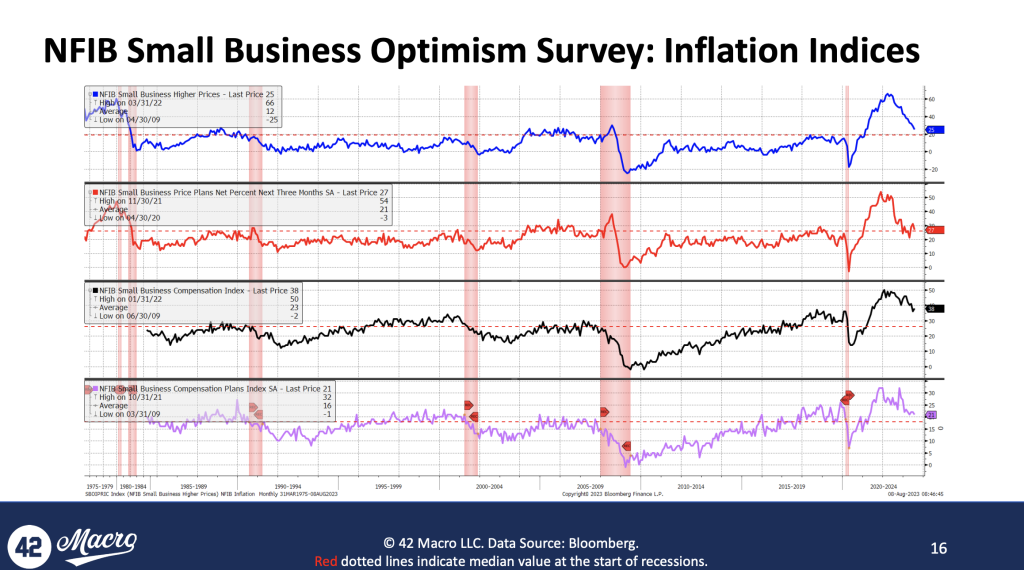

A return of inflation pressure destroys the “transitory GOLDILOCKS” narrative and potentially derails the actual GOLDILOCKS US economy that has supported risk assets for the past few quarters, paving the way for a cross-asset crash. Our qualitative research views expect that process to occur within 3-6 months.

Last week’s +1.8pt MoM advance in the ISM Services PMI (54.5 = 6mo high) was adequately presaged by the New York…

Darius recently sat down with Maggie Lake to discuss the energy sector, the labor market, the resiliency of the U.S….

Darius recently sat down with Anthony Pompliano to discuss global liquidity, bitcoin, the Fed, and more. Here are…

Darius recently sat down with Nick Halaris to discuss proper risk management, the labor market, inflation, asset…

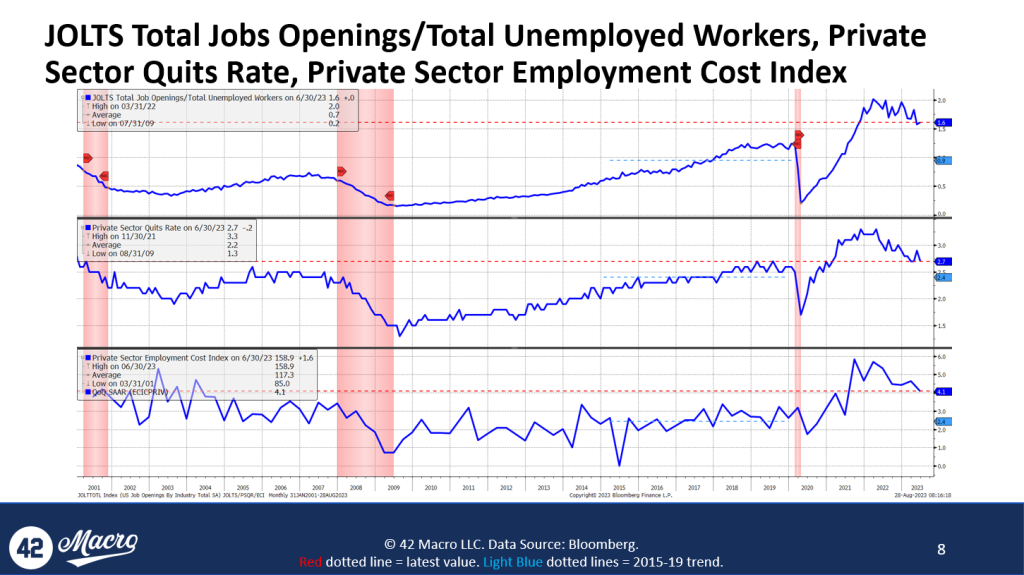

The ~150,000 member United Auto Workers (UAW) union has declared “war” on Detroit’s big three auto makers GM $GM, Ford $F, and Stellantis $STLAM IM. Here’s what that means for inflation and the bond market volatility in the coming months:

Odds Are You Suck at Predicting, So Stop Now that we have your attention, let’s spend the next 90 seconds together…

This week, Darius sat down with Maggie Lake from Real Vision to discuss the resiliency of the US economy, the housing…

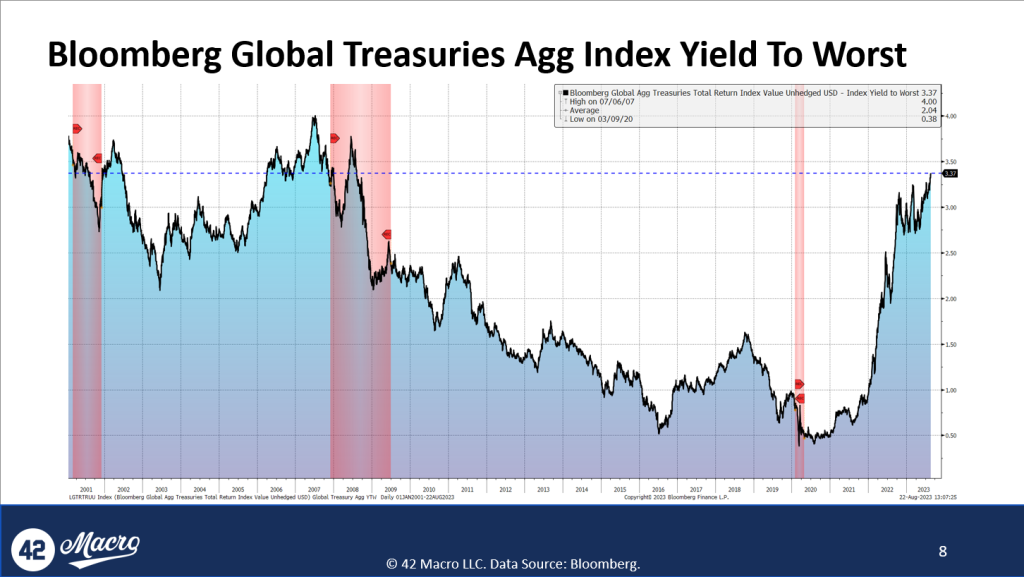

Global bond yields hit their highest level since 2008 as investors were forced by the data we have been highlighting to reprice economic resiliency in places like the US and Japan, as well as sticky inflation in places like the Eurozone and UK.

Last week, Darius sat down with Paul Barron to discuss global bond markets, #inflation, #bitcoin, and more. If you…

Earlier this week, Darius sat down with Anthony Pompliano to discuss all things global liquidity. If you missed the…

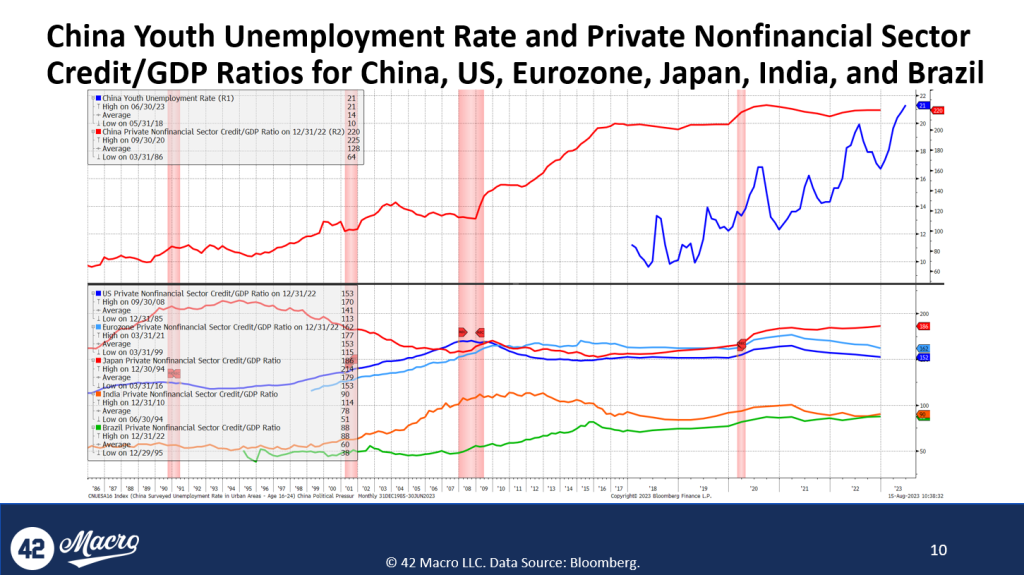

The economic situation in China continues to be an unmitigated disaster, with the July Retail Sales, Industrial…

Earlier this week, Darius sat down with Kris Sidial from the Ambrus Group on 42 Macro’s Pro to Pro Live show to…

The August University of Michigan Consumer Sentiment was marginally confirming of our “resilient US economy” theme.

One recent data point that gives us confidence we are not at the start of a market crash is the July NFIB Small…